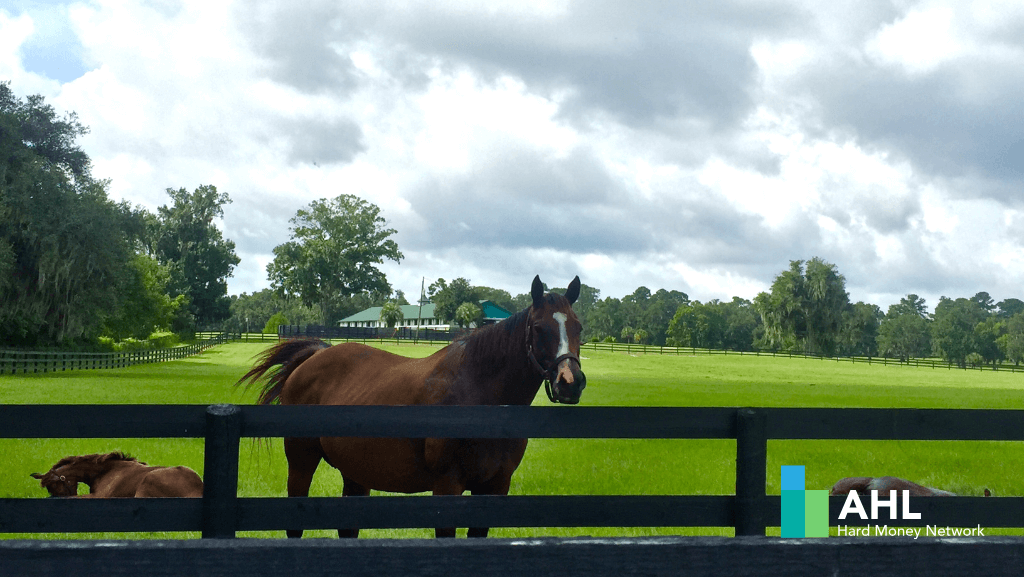

You're in a common situation for self-employed individuals with significant assets but insufficient documented income for traditional bank loans. Ocala, being the "Horse Capital of the World®," is a prime location for hard money lenders specializing in equestrian properties.

When traditional banks say no because you're self-employed and your tax returns don't reflect your true income, but you own a valuable horse farm and land free and clear, hard money equity loans become your best friend. These loans focus on the asset's value (your horse farm) and your equity in it, rather than your credit score or documented income.

Ocala is home to over 1,200 horse farms, and around 600 thoroughbred horse farms alone. This indicates a very active market for equestrian properties. The value of these properties can vary wildly based on acreage, facilities (barns, arenas, tracks), location, and historical significance.

Let's imagine some scenarios for a cash-out refinance with a hard money lender, assuming you own the property free and clear and have horrible credit:

Scenario 1: 20-25 Acre Horse Farm

Scenario 2: 50 Acre Horse Farm

Scenario 3: 100 Acre Horse Farm

Important Considerations for all scenarios:

While hard money loans come at a higher cost, their ability to bypass traditional lending hurdles for self-employed individuals with significant equity makes them an invaluable tool for accessing capital from your prized Ocala horse farm.

© 2025 AHL Hard Money Loans - All Rights Reserved | Privacy Policy | Website by DigiSphere Marketing